how to claim utah solar tax credit

Everyone in Utah is eligible to take a personal tax credit when installing solar panels. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

That means that if the gross system cost is 20000 your tax credit would be.

. Install a solar energy system. To claim your solar tax credit in Utah you will need to do 2 things. File for the TC-40e.

You will not receive your. Utah you can claim 25 percent of your photovoltaic costs up to 1600 if you install a solar energy system by then end of 2020. The 3 steps to claiming the solar tax credit.

In accordance with Utah Code 63M-4-401 the Utah Governors Office of Energy Development OED charges a 15 application fee. You can claim 25 percent. Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000.

The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects. In the TurboTax Utah. Note that because reducing state.

Receive and save your TC-40E. To enter it in TurboTax please see the instructions below. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply.

As a credit you take the amount directly off your tax payment. Claim the credit on your TC-40a form submit with your state taxes. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22.

Steel windows 13 steel windows windows steel doors. Utah customers may also qualify for a state tax credit in addition to the federal credit. You can claim the state credit for more than one system as long as each one is installed on a residential unit that you.

Complete IRS Form 5695. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum. Fees must be paid by credit card.

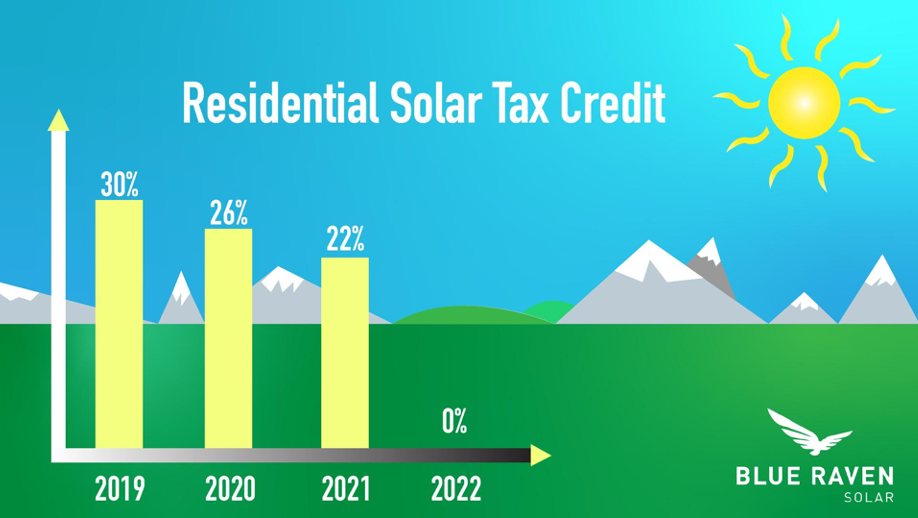

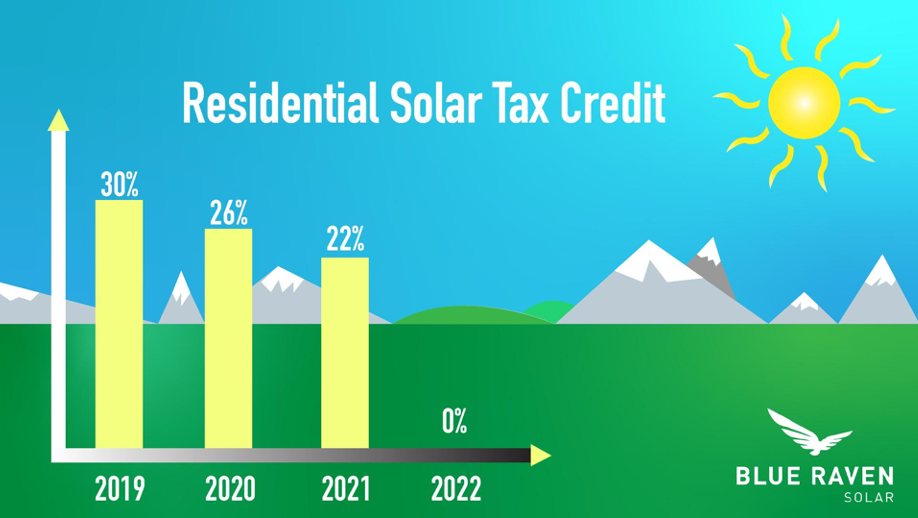

You enter the total tax you owe before credits in line 1 of the worksheet and the amounts of any fully refundable credits on the lines within step 2 adding them all on the final. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. The Federal Investment Tax Credit ITC is 26 of the gross system cost of your solar project.

There are three main steps youll need to take in order to benefit from the ITC. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes. The credit is claimed by entering the allowable credit on Utah TC-40A Part 5 using code 39.

Rooftop solar installations are eligible for a 30 federal tax credit and a 25 state tax credit capped at. The solar ITC in Utah isnt limited to one photovoltaic system either. Determine if youre eligible.

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up to 2000. Attach TC-40A to your Utah return.

Utah State Tax Credit Instructions. 026 1 022 025 455. Create an account with the Governors Office of Energy Development OED Complete a solar PV application.

Community Systems Offer Alternative Paths For Solar Growth Minnesota News Us News

Understanding The Utah Solar Tax Credit Ion Solar

Coloring Page Wind Energy Windmill Img 3022 Energia Eolica Eolica Energia Renovable

Solar Tax Credits 2020 Blue Raven Solar

Understanding The Utah Solar Tax Credit Ion Solar

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Understanding The Utah Solar Tax Credit Ion Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Utah Solar Incentives Creative Energies Solar

Solar Tax Credits 2020 Blue Raven Solar

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

11 Smart Questions Answered The Facts On Massachusetts New Solar Program Climate Xchange

Solar Tax Credit Details H R Block

Solar Incentives In Utah Utah Energy Hub

/cdn.vox-cdn.com/uploads/chorus_asset/file/21812019/iStock_157611159.jpg)

Intermountain Wind And Solar Review This Old House

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Credit 2022 Incentives For Solar Panel Installations