charitable gift annuity calculator

Need help calculating expected income from a charitable gift annuity. The payments reduce or even eliminate the transfer taxes due when the remaining funds revert.

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Wills Trusts and Annuities Home Why Leave a Gift.

. This comprehensive report discusses the origin of gift annuities how they are designed and regulated. 13-5563422 Contact the Planned Giving Team Dont see what you need. A charitable gift annuity offers many benefits to donors such as.

The gift planning information presented on this Planned Giving website of National Gift Annuity Foundation is not offered as legal or tax advice. NOTIFY US Red Dress DHHS Go Red AHA. Simply input the amount of your possible gift the basis of the property and the ages of the planned income recipients.

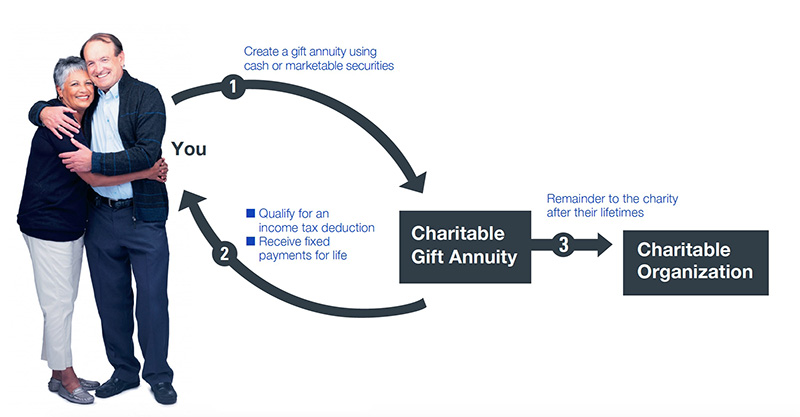

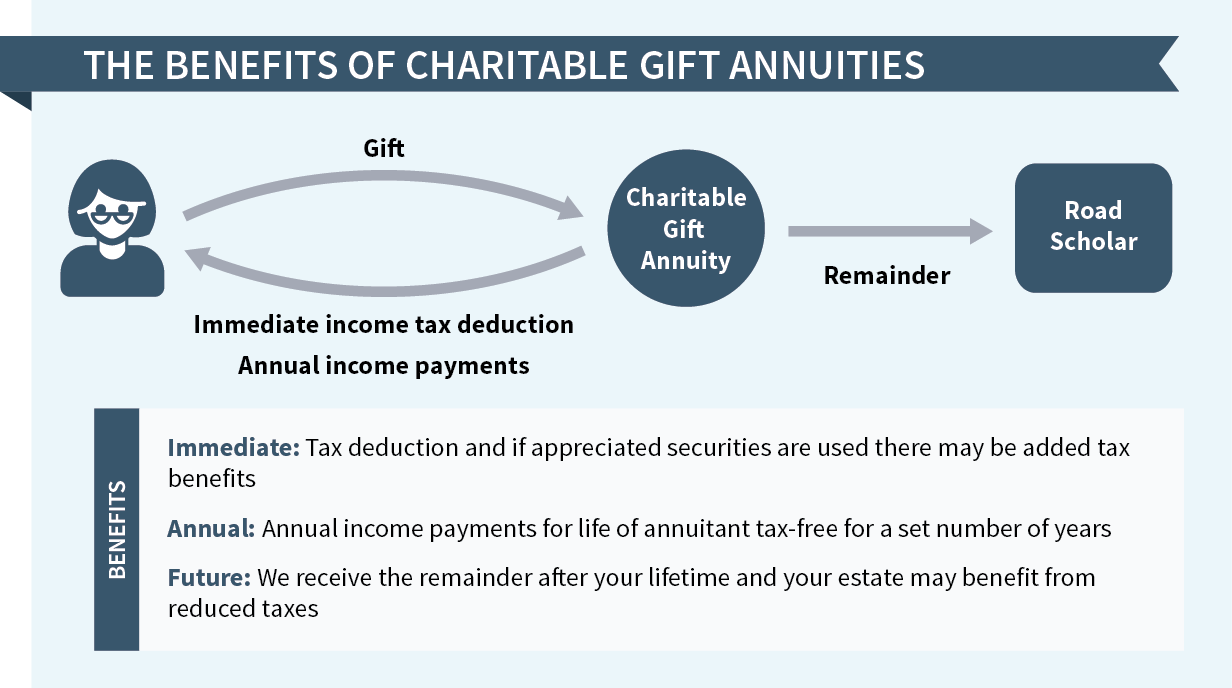

In exchange for an immediate gift to a legitimate 501 c 3 charity the donor is promised a specified lifetime income. If you are 60 years or older or 65 for two individuals make a gift of 10000 or more with cash or appreciated stocks part of which is tax-deductible and receive. Charitable Gift Annuities.

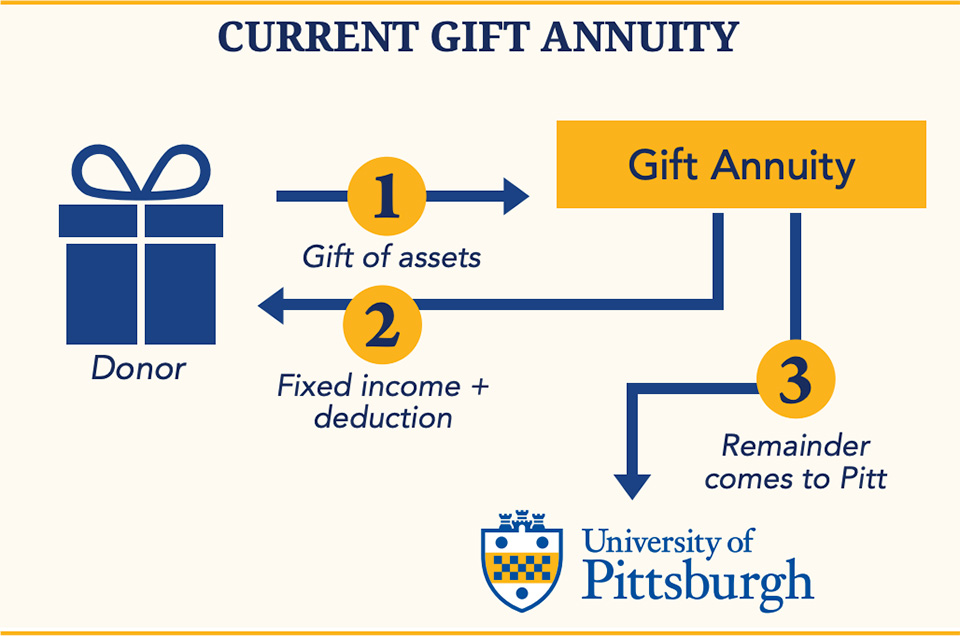

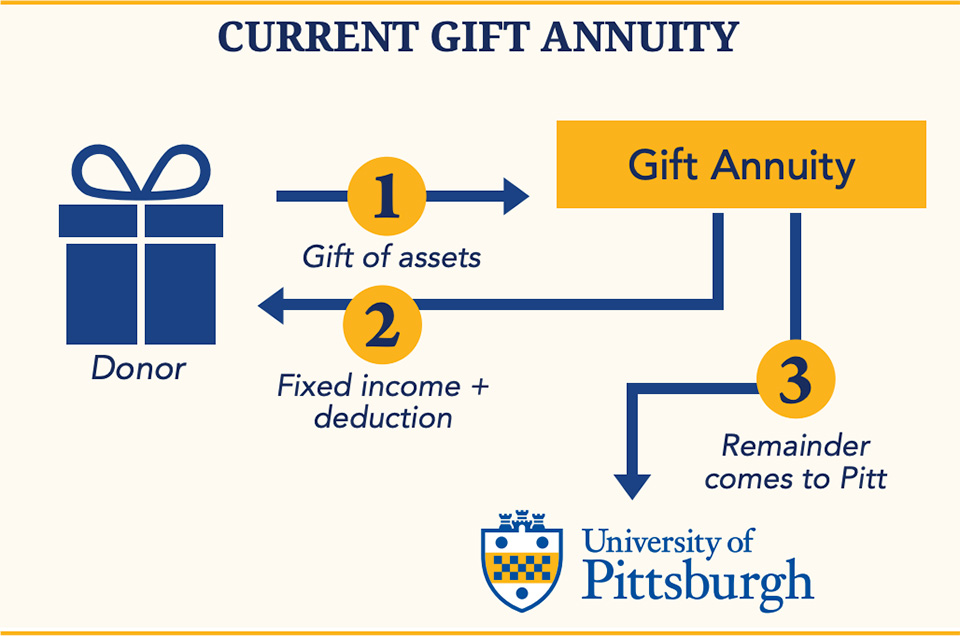

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Your calculation above is an estimate and is for illustrative purposes only. Charitable Lead Unitrust link opens in new window - Pass on assets to your loved ones at reduced tax rates.

Use our handy Gift Calculator. In exchange the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies. The income from annuities is guaranteed until the donor dies.

The gift planning information presented on this Planned Giving website of American Heart Association is not offered as legal or tax advice. Your calculation above is an estimate and is for illustrative purposes only. Annuity reserves are the assets a charity needs in order to finance its gift annuity payment obligations.

The annuity starting date for purposes of calculating the deferred gift annuity rate will be the same as the annuity starting date for. Rates for a Charitable Gift Annuity funded January 1 2020 or later. Typically the life income goes to the donor or is shared as a 100 percent joint and.

Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a. A CGA is one of the easiest forms of planned giving.

It is possible for donors to support a. Jacksonville FL 32205. In exchange for your gift of cash or appreciated securities you receive fixed income for life.

Use our online form to get in touch. National Wear Red Day is a registered trademark. It is possible for donors to support a philanthropic cause and profit at the same time.

Charitable Remainder Annuity Trust Calculator. With decades of experience the experts at NGAF can customize a solution which fits your situation and provides the charitable outcome you have in mind. A charitable gift annuity is one of the easiest ways to support cancer research at UCLA.

Complete the form below to calculate your income for life and tax benefits or contact our gift planning team at 800-922-1782 or email giftplanninghmsharvardedu for a personal gift illustration. It provides a steady cash flow and can be more beneficial than keeping an asset or selling it outright. Notify us so we may thank you for your future gift.

The results will provide an overview of benefits including payout details deduction. Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and 77 for donors age 80. This calculator estimates the federal income tax deduction for a donor s based on parameters you specify.

You also benefit from an immediate charitable income tax deduction and a significant portion of the annuity payments is tax-free. The amount of reserves needed to finance each gift annuity depends on the size of the annuity payments the ages of the annuitants. The exact amount of that gift is agreed upon at inception.

A charitable gift annuity is described generally as a transaction in which an individual transfers cash or property to a charitable organization in exchange for the charitys promise to make fixed annuity payments to one or two life annuitants. Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. And as with any charitable giving and estate planning issues consulting an experienced advisor is the best way to ensure that youre accomplishing.

A great way to make a gift receive fixed payments and defer or eliminate gains tax. Charitable Lead Annuity Trust link opens in new window - Reduce or possibly eliminate gift and estate taxes while receiving fixed payments. The information you enter below will be kept completely confidential.

A charitable gift annuity offers many benefits to donors such as. Indicated charitable deduction percentages for compared charitable remainder unitrusts charitable remainder annuity trusts andor charitable gift annuities are based on the highest of the Federal Section 7520 rates in effect for the current and two preceding months resulting in the highest allowable charitable deduction and assume that. Please click the button below to open the calculator.

Before you start please note the following. National Gift Annuity Foundation. It does not constitute legal or tax advice.

There are many types of assets that can be donated including cash securities and personal property. A Charitable Gift Annuity is a simple secure arrangement that benefits Samaritans Purse provides an income to you andor a loved one and offers substantial tax benefits. The calculator below determines the charitable deduction for any of the following gift types.

Ways to Gift Meet Our Donors. The charity to which you donated can also assist you with the calculations and many even offer online calculators that will help you determine how a charitable gift annuity might benefit you. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators.

The income from annuities is guaranteed until the donor dies. Your calculation above is an estimate and is for illustrative purposes only. Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington Street Baltimore Maryland 21201-3443 Federal Tax ID.

It does not constitute legal or tax advice. Or call us at 800-235-2772. Rates for a Charitable Gift Annuity funded July 1 2018 or later.

Charitable Gift Annuity Calculator. If the sole annuitant will be nearest age 65 on the annuity starting date and the compound interest factor is 21082 the deferred gift annuity rate would be 21082 x 60 126 rounded to the nearest tenth of a percent.

Does A Charitable Gift Annuity Make Tax Sense For You

Charitable Gift Annuity Giving To St Lawrence

Download Letter Of Intent Style Template For Free At Templates Hunter With Bequest Letter Template 10 Profession Letter Templates Letter Of Intent Lettering

Consumer Report Gift Annuity Calculator

Planned Giving National Park Foundation

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Charitable Gift Annuities Road Scholar

Charitable Gift Annuities Giving To Stanford

Specimen Agreements Charitable Gift Annuity Planned Giving Resources Coursera

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuities Development Alumni Relations

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities Kqed

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities The University Of Pittsburgh

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center